Important Links

What You Should Know About the ESPLOST

What is an ESPLOST?

The Education Special Purpose Local Option Sales Tax, or ESPLOST, is a one-cent tax that is dedicated for use by school systems to fund public education. Continuing this penny tax shares the responsibility of funding education with anyone who shops in Monroe County, visitors or residents. By law, an ESPLOST can only be used for certain capital projects, like buildings, furnishings, instructional materials and vehicles. It cannot be used for salaries or operational expenses.

Is the proposed ESPLOST a new tax? How long would it be in effect?

The ESPLOST is not a new tax, but a continuation of one already being collected in Monroe County. The first ESPLOST took effect in 1999 and has been continued every five years since. If the extension is approved by voters, the penny would be collected for a 5-year period beginning when the current ESPLOST reaches its cap of $24,000,000.

Why is the district renewing the ESPLOST now?

Current projections show the existing ESPLOST will reach its cap in Fall of 2023. Approving the continuation in November of 2022 would ensure that the penny would continue to be collected. It would also allow Monroe County Schools to begin its next capital projects plan to meet the district’s needs as facilities age and enrollment climbs.

What will be funded if voters approve a continuation of the sales tax for education?

Monroe County Schools plans to do the following:

Add to, renovate, improve, and equip existing school buildings and facilities

Construct and equip new school facilities, including a ninth grade campus, a field house and stadium improvements, and a multi-purpose building

Acquire land for future schools and facilities

Acquire miscellaneous new equipment, fixtures and furnishings for the school system

Acquire band instruments and equipment, text books and library books, including electronic media

Acquire school buses, vehicles, and transportation and maintenance equipment

How much will the proposed ESPLOST raise for Monroe County Schools?

A total of $39,500,000 is projected to be raised in the 5-year collection period.

The ballot question mentions $25,000,000 in general obligation bonds that will be approved as well. What does that mean?

These bonds will provide the district with funding prior to the collection of sales tax, allowing Monroe County Schools to move forward with any needed building construction or renovations totaling no more than $25,000,000. These bonds will be paid for with sales tax proceeds as that revenue is collected.

What happens if voters do not approve the continuation of the ESPLOST?

The tax revenue collected through the ESPLOST is the primary source of funding for capital projects, including building and maintaining our school facilities. Without it, Monroe County Schools will be limited in its ability to construct needed new buildings, purchase necessary technology, install safety upgrades, and other needed capital projects. The ESPLOST funding helps provide needed resources for the school system, while keeping property taxes low for Monroe County residents.

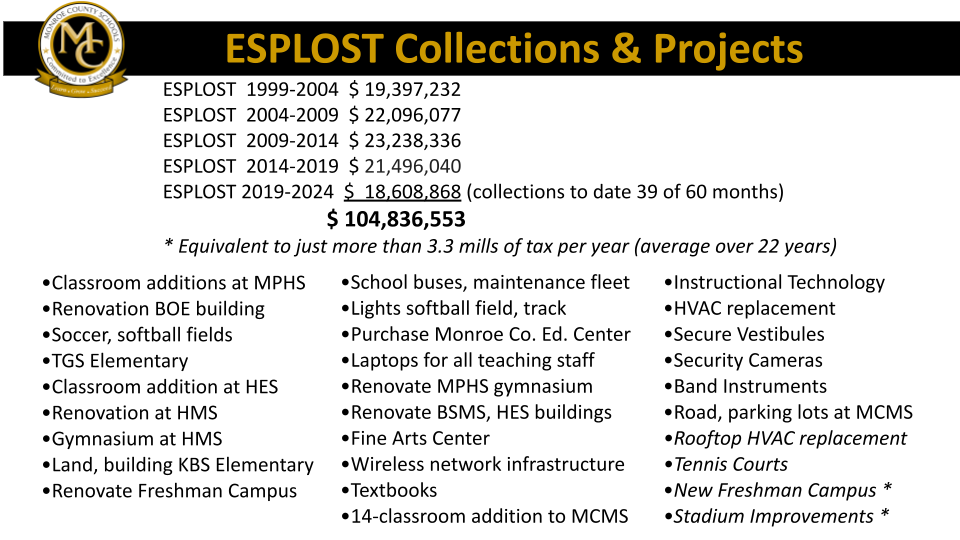

How has the ESPLOST been used to support our school district?